Edit: This question attracted way more interest than I hoped for! I will need some time to go through the comments in the next days, thanks for your efforts everyone. One thing I could grasp from the answers already - it seems to be complicated. There is no one fits all answer.

Under capitalism, it seems companies always need to grow bigger. Why can’t they just say, okay, we have 100 employees and produce a nice product for a specific market and that’s fine?

Or is this only a US megacorp thing where they need to grow to satisfy their shareholders?

Let’s ignore that most of the times the small companies get bought by the large ones.

Yeah that’s the entire problem.

“Always bigger” is delusional or cancerous.

Change the “or” to a “and”, and you got it.

In the strictest definition, they don’t.

Capitalism is minimally fulfilled when a business sells something for a profit and reinvests the profit (now capital) in the business. Hence the term. It doesn’t have to grow the business, make new products, or do anything beyond maintenance of its processes, be that fixing or updating machinery or training employees. A single person selling tomatoes in a market in Madagascar that fixes of their tomato table with profits is perfectly capitalist.

Expecting constant growth is not a requirement of anything.

A farmer selling their produce is not necessarily a capitalist. A farmer toiling on their own field sells the fruit of their own labor, so to speak. One step up are what Marx calls “Little Masters”: They own and work their means of production, but sometimes have employees such as farmhands or apprentices (Think companies where the owner still works in the workshop). Actual capitalists are detached from the production process: They no longer work, but simply own the so-called means of production and exploit others by buying their labor force for less than their produced result is worth.

If we are going by the original definition of the word, it is. The farmer here is growing produce to sell it in exchange for money; they are not sharing it with their community, bartering with it, growing it to eat themselves, or giving it to their liege lord.

I’m not sure why people always insist if money is involved that it’s capitalism. Money is an abstract form of trade. No one is suggesting that trade will cease to exists in a world without capitalism.

It’s not about money, it’s about private ownership of capital. https://en.wiktionary.org/wiki/capitalism

Well, if you assume the farmer excludes others from using the means of production i.e. the fields, then yes you can argue that they are acting as capitalist. But you have to make the distinction between private and personal ownership: Private ownership of the land and personal ownership of the produce. The former is what communists reject. The latter is fine in their books.

Well, I’d say that the definition of capitalism changes depending on if you’re talking about capitalism as opposed to feudalism (original/historical definition) vs capitalism as opposed to communism (modern definition).

What resources would you recommend to someone wanting to learn about this?

I.e. the TV channel Arte, which is a cooperation of French and German state media has a multipart documentary called Work, Salary, Profit that touches on a lot of fundamentals.

Of course there is always the option just to straight up read the original works by Marx, Smith and so on, but they are not for the feint of heart.

People frequently conflate capitalism with enterprise, not seeing the distinctions.

An economic model that includes capitalism explains a lot of the world including having some close process analogs in nature.

A capitalist sounds like a label you’re trying to apply in an attempt to label someone as being maximally for profits. A lot of companies admittedly work that way and it’s important to include that concept.

By my reading you’re taking the use of the first term and then saying they are using the second term. I think this is called equivocation.

All companies work that way, or they risk to fail. The maximization of profit stems from the need to stay competitive. If your competitor can produce the same amount of goods for a lower price, you won’t be able to sell yours for a cost-covering price and therefore go bankrupt. Instead, you then have to find a way to be more efficient by investing in your business. To be able to invest, you have to have created profit. Once you have done that, your competitor has to do the same and the cycle starts anew. That’s the idea of modern capitalism.

By my reading you’re taking the use of the first term and then saying they are using the second term. I think this is called equivocation.

I am not sure what you mean by that. I tried to show that just because someone sells something, they are not necessarily a capitalist.

The question says capitalism (not so loaded term) your answer said capitalist (more loaded term and you’ve taken time to use the loaded part of the term).

That said, I accidentally replied to a question in lemmy.ml so the person asking the question is probably more aligned with your way of thinking and explaining than I am. Sorry about that

Well, to me that sounds a little like you prefer the term swimming over being called a swimmer.

Oh, I didn’t say I had a preference. And I see your point that one is just a conjugation of the other. I’ve just seen capitalism as a term used more for explanation and when I’ve seen capitalist said it tends to have a negative connotation at best but more often it is half spat out

If you want to nitpick, I never said farmer. Also, farmers have inputs, so your comparison is wholly removed from reality.

Edit: also, Marx? JFC, Thoreau is a better example of 19th century philosophy about labor, as he actually did real work in life which is why he manged to influence Tolstoy, who the eurdite Soviets tried to retcon into being a socialist because they were arrogant tools who didn’t understand his work well enough to realize that his critiques were often of people just like them. And just like Marx who also had very little contact with real life.

Marx can suck a fuck at the tomato stand, my friend.

What does a farmer having inputs have to do with my argument being removed from reality?

-

Because you’re leaning on Marx for definitions, who was famously out of touch with reality as well,

-

because ALL small business owners need inputs, and labor is only one of them, so inventing the vendor as now a farmer to attempt a workaround is disingenuous,

-

you also had made the tomato vendor into a farmer in hopes of having a point that fits into a poorly crafted 19th century framework, and don’t know enough about how farms anywhere on earth to realize how blatantly wrong you are,

-

your definition of capitalist is factually incorrect,

-

read my edited comment above, which I edited while you wrote this,

-

a farmer is no different, functionally in a minimalist sense, from a person making jam as a cottage industry, who buys fruit and processes it at home, making a farmer’s field not magic but simply a location where work is done,

-

I said tomato seller, which is someone that spends their labor time buying tomatoes from farms as a risk and selling them in the market. They own means of logistics, which for anyone not stuck in 1862, would consider essentially a means of production as well, as it takes an input and renders is viable to trade for a medium of exchange. Does a fisherman owning a boat mean she owns the means of production when it’s fish spawning grounds that make fish? It’s a stupid argument to cling to one you’ve already written your first PoliSci paper about it and get it.

Look, everything is connected, and there is no terminal point of anything from which anarcho-socialist magic can magically arise and flow down to make some post-consumption utopia. It’s a circle with no beginning and no end. You can’t force economic change to change human behavior, and Marx’s ideas have famously failed hard. Over and over. Spectacularly.

You’re taking about a 30 generation cultural change that you won’t ever see.

It would certainly help a lot if you could tone down your condescending attitude a little.

I fail to see where anything you write is an actual argument against my distinction between different forms of working with the means to produce something. Yes, I’ve misread your vendor as a farmer, but that’s not a reason to go ad hominem.

Marx’s definition of “the means of production” is both not in tune with how anything has ever worked, and ignores that Marx basically used real estate as the definition because he was closer to European feudalism than us. Marx grew up and spent his uni years as a subject of the Prussian Kingdom, and industrialization and land ownership were entirely different in his time.

Context matters. And apologies for being condescending, but it pisses me off to no end when people wax poetic about some pastrolaist socialist agrarian sunshine butterfly state when if you’ve never experienced it, actually sucked and everyone hated it who was in it, even in the modern era.

Bro what?

- Because you’re leaning on Marx for definitions, who was famously out of touch with reality as well,

Are we just supposed to believe what you’re saying? Because I have easy counter-argument. You’re out of touch with what Marx wrote and if say-so if enough proof then this statement is proven and you’re wrong. Now, unless you can actually prove this statement we can argue this point.

- because ALL small business owners need inputs, and labor is only one of them, so inventing the vendor as now a farmer to attempt a workaround is disingenuous,

This literally does not change the original argument. Do you think farmers do not need an input? What disqualifies a farmer from being a small business owner?

- you also had made the tomato vendor into a farmer in hopes of having a point that fits into a poorly crafted 19th century framework, and don’t know enough about how farms anywhere on earth to realize how blatantly wrong you are,

Do you think they didn’t have food vendors in the 19th century? Do you think a tomato vendor is a 20th or 21st century concept that invalidates this supposed 19th century argument?

- your definition of capitalist is factually incorrect,

I guess this is another “we just have to believe you” points. Just because you don’t understand Marx’s definition of capitalism doesn’t mean it’s wrong.

- read my edited comment above, which I edited while you wrote this,

Why is this even a point?

- a farmer is no different, functionally in a minimalist sense, from a person making jam as a cottage industry, who buys fruit and processes it at home, making a farmer’s field not magic but simply a location where work is done,

I’m not 100% sure what you’re even trying to say here but if you’re saying what I think you’re saying, Marx would agree with you here.

- I said tomato seller, which is someone that spends their labor time buying tomatoes from farms as a risk and selling them in the market. They own means of logistics, which for anyone not stuck in 1862, would consider essentially a means of production as well, as it takes an input and renders is viable to trade for a medium of exchange. Does a fisherman owning a boat mean she owns the means of production when it’s fish spawning grounds that make fish? It’s a stupid argument to cling to one you’ve already written your first PoliSci paper about it and get it.

I guess you also don’t believe logistics existed before 1863. Also your logistics argument doesn’t contradict Marx. And a fisherman owning a fishing boat would mean they own the means of production because the boat is A TOOL to catch fish. The fish don’t magically jump into the fishermans hands. They need to be caught, which requires labor and to ease that labor tools are used. Fish existing doesn’t make a fisherman a fisherman, otherwise I’d be a lumberjack simply because there’s a forest near my home.

I suggest you actually try to understand Marx before you start mindlessly criticizing something.

deleted by creator

I understand Marx fine. He was an academic who grew up the privileged son of a lawyer, and never spent a day of his life worrying about how he was going to feed his family by working on a farm or in a factory.

His ideas about land alone being enough to be considered “means of production” are informed by 19th century feudalist-cum-post-feudaliast Europe, and the transition point between the Prussian Kingdom and a unified and nascent German state as it industrialized.

His view of industrialization is like that of Upston Sinclair: “Holy shit, WTF? This is terrible.” Trauma and secondary trauma informed by other people. But as an academic his understanding of how the economy works at the level of what was a rapidly changing factory scene. 21st century economics don’t fit 19th century ideals.

And you as a lumberjack is the perfect example. You might own a saw and live near a forest. Cut all the trees you want. Who will buy them without access? So now you need a road. But your 19th century horse cart can’t drag a 400kg log anywhere to sell it, so you now need to buy a truck and loading system. Only now too you have an actual logging setup that gets your product of raw timber to a mill for sale. Marx calls all these things the means of production, which is cute, but he assumes that the social whole is different.

The road needs to be graded and maintained, your saw oiled and sharpened, your truck maintained. Which all also needs labor to happen. As was the cries of trucking unions when the Teamsters formed, you are just part of the machine. Which means that when you get down to it and nitpick, everything and everyone is a part of the means of production of something else. There are no gaps and no bourgeoisie locking up every critical aspect of the social whole, and small businesses as the largest employer in the US mean that Marx’s theory doesn’t stand up to reality anymore. The end user and end consumer provides demand, which is as necessary as the road and truck and mill for you as a faux lumberjack. Demand is a human non-labor aspect of the social whole we all have, which is more important than the means of production. Just ask the bourgeois board of Blockbuster Video, or a small local newspaper.

Right. There’s so much wrong here that I won’t even bother correcting you on everything. You start off not by addressing his points but by trying to character assassinate so you wouldn’t have to address his points. Absolutely disingenuous.

Then between your ramblings you make statements that Marx would disagree with (like land alone being enough to be the means of production) or you try to disprove Marx by stating something Marx himself used as a foundation for the criticism of capitalism (like everything and everyone being a part of the means of production of something else). And finally you make apparently clear you have not read even a summary of his biggest works, Das Kapital, because you say stupid shit like this:

There are no gaps and no bourgeoisie locking up every critical aspect of the social whole, and small businesses as the largest employer in the US mean that Marx’s theory doesn’t stand up to reality anymore.

Das Kapital goes into great lengths specifically to prove those “non-existent” gaps exist. They existed 2 centuries ago and they still exist. And the fact that you think his criticism does not apply to small businesses is just another example of how little you actually understand what Marx wrote.

-

I would argue that this is not really true under capitalism. The logic of capitalism is one of capital accumulation, which requires growth. Under other systems you still have markets and money and profits but there are other goals than the accumulation of capital and therefore achieving “homeostasis” is a successful strategy-a business run with consistent inputs and outputs which includes a sustainable profit.

You don’t need to argue anything, because there is no universal definition of capitalism. Were not trying to define it.

But the term itself requires capital to be involved, and for a business to exist, that capital needs to be reinvested in the business. That doesn’t require growth. The absolute minimal state simply requires pricing a good sold at a net profit. That’s all. Growth isn’t a requirement.

While this is mostly true it’s certainly the case that publicly traded companies have strong incentives to grow.

Private companies mostly have the ownership, and/or the desire to go public to blame.

And publicly traded companies are the also the minority of the total number of companies in the US. So this is a niche issue with outsized effects, meaning a policy solution is out there that

This mostly only happens to companies with outside investors, and it’s in order to make the investors happy.

Companies owned privately by one or a handful of people who all just want the company to keep going, make a decent profit, and be sustainable, don’t always exhibit the “need for growth” behavior.

It’s usually because the investors don’t really give a shit about the company or its mission, they just want money. Often this kind of “need for growth” bullshit is just short term growth, since that’s what most investors care about. It stifles the company’s ability to plan for long term growth and make the right decisions to achieve it.

This includes all publically traded companies

Bingo.

There are also stable companies with a solid revenue stream that don’t have much growth potential, so pay out the profits as dividends. These are more in demand for retirement funds or individuals who get to point in life they need to start living from their investments. Yield is always a calculation of dividend + growth.

Tech companies that don’t pay a dividend and reinvest everything into growth is a relatively new concept

Well, partially maybe. In the past, investors were happy with dividends instead of growth. There are extra factors making growth be preferable over dividends nowdays.

It’s not “companies”, it’spublicly traded companies.

And the answer is quite simple really: the moment you become publicly traded your stock becomes your product, and everything else becomes a means to deliver better stock prices to your investors.

Not all companies are publicly traded, I patronise privately held companies wherever possible because as a client I’m still at the core of their business strategy, and I’m wary of the alternative.

At the end of the day, bad strategies result in bad products and services. Vote with your wallet, it’s very possible.

I work for a privately owned company and we’re absolutely expected to grow. Being privately owned doesn’t change that.

Right but you don’t have a basically legal obligation to if you’re private

??? Of course you do. Investors don’t just buy their way into hypothetical future profits, they buy control over the company. The specifics depend, whether it’s voting shares or the looming threat of debt collection, but the courts will 100 % enforce investors’ right to demand things from companies.

Furthermore the idea that publicly traded companies have some kind of obligation to make as much money as quickly as possible is a reddit-born myth. Shareholders will bring in a CEO, who will be tasked to do whatever and can be fired from the shareholders at any time. Grievous mismanagement and intentional damage can expose a CEO to legal action, just like intentionally destroying tools can expose a worker to legal action. But a CEO acting in good faith has no other obligation than to fulfill the tasks asked of them by shareholders. The problem is that goes wrong when large shareholders plan to sell their shares and need the numbers to look a little better to sell a little higher. But this phenomenon absolutely happens with PE as well – in fact it’s arguably way worse because publicly traded companies at least have legal obligations of financial transparency. Private shareholders can do whatever the fuck they want, including secretly selling their shares to Evil Inc. for them to strip the company for parts and not a single employee has the right to even know who the majority shareholder even is, nervermind what their plan is.

Furthermore the idea that publicly traded companies have some kind of obligation to make as much money as quickly as possible is a reddit-born myth.

Shareholder primacy wasn’t born on reddit, it was actually Milton Friedman who theorized of it, the Michigan Supreme Court who wrote it into precedence, and now American citizens who have to live under the consequences of publicly traded corporations having a distinct legal obligation (against the belief of some legal academics who argue otherwise, in bad faith nonetheless) to provide a profit for shareholders. This also applies to PE, who take this notion of a, once again, distinct legal obligation to provide profits for shareholders above all else, as what you would call a “Get out of jail free card,” i.e. fraud and thievery is completely fine if you’ve got shareholders to feed.

But a CEO acting in good faith has no other obligation than to fulfill the tasks asked of them by shareholders.

Shareholders: “We demand more profits, please start acting in bad faith so I may purchase another boat this afternoon”

CEO: “ok”Alternatively:

Shareholders: “Profits, please”

CEO: “no”

Michigan Supreme Court: “The death sentence is on the table”This is how this has played out since 1919, Dodge v. Ford Motor Co. Wax poetic about theory, in reality people are starving over the sheer necessity that the shareholders want another buck.

Growth and constant growth are not the same.

Obviously growing a business is positive in some circumstances, the point is that growth for growth’s sake becomes the name of the game once you go public, whereas when privately held the company can decide whether it makes sense to grow in that moment or focus on other goals in the short term to benefit a long term strategy.

That is a myth. The law is actually far more complicated, at least in the U.S., and presumably elsewhere too.

Please elaborate because everything written above is correct. Companies must maximize value.

The leading statement of the law’s view on corporate social responsibility goes back to Dodge v. Ford Motor Co, a 1919 decision that held that “a business corporation is organized and carried on primarily for the profit of the stockholders.” That case — in which Henry Ford was challenged by shareholders when he tried to reduce car prices at their expense — also established that “it is not within the lawful powers of a board of directors to shape and conduct the affairs of a corporation for the merely incidental benefit of shareholders and for the primary purpose of benefiting others.”

Because they run out of “create” and they’re slaves to the quarterly report.

A new company that makes/sells a widget that is desirable will grow naturally from the demand for the product. It has to get bigger to manage the demand. They go public to get more money to grow more quickly. Those public investors expect a return on their stock investment purchase.

Now competitors show up. Competition is bad for our big startup (despite being a supposed tenant of the free market that allowed our company to grow quickly in the first place) that is now a major power in the widget industry. You can only make the widget so many ways, can’t really improve it, and the market is becoming saturated. So what happens next? WidgetCo’s stock is flat! Investors are mad! The CEO is in trouble! Now we do acquisitions and enshittification. Buy the competitors and adjacent product makers. Now there’s “growth” again even though nothing new is made, in fact the product gets worse and nobody gets hired as they want attrition to get rid of redundant employees. The hope is that the widget is so engrained in society that it can’t be done without. Now do unbundling. Subscriptions. Sunsetting. Modify the product so that new versions must be bought due to batteries or servers no longer supporting previous versions. If you can’t make new things, make the customer buy new versions of the same old things.

Gotta keep pushing that quarterly report line up to keep the investors happy and the CEO bonuses coming.

They don’t.

See local businesses that remain a single location for generations.

It is a want not a need.

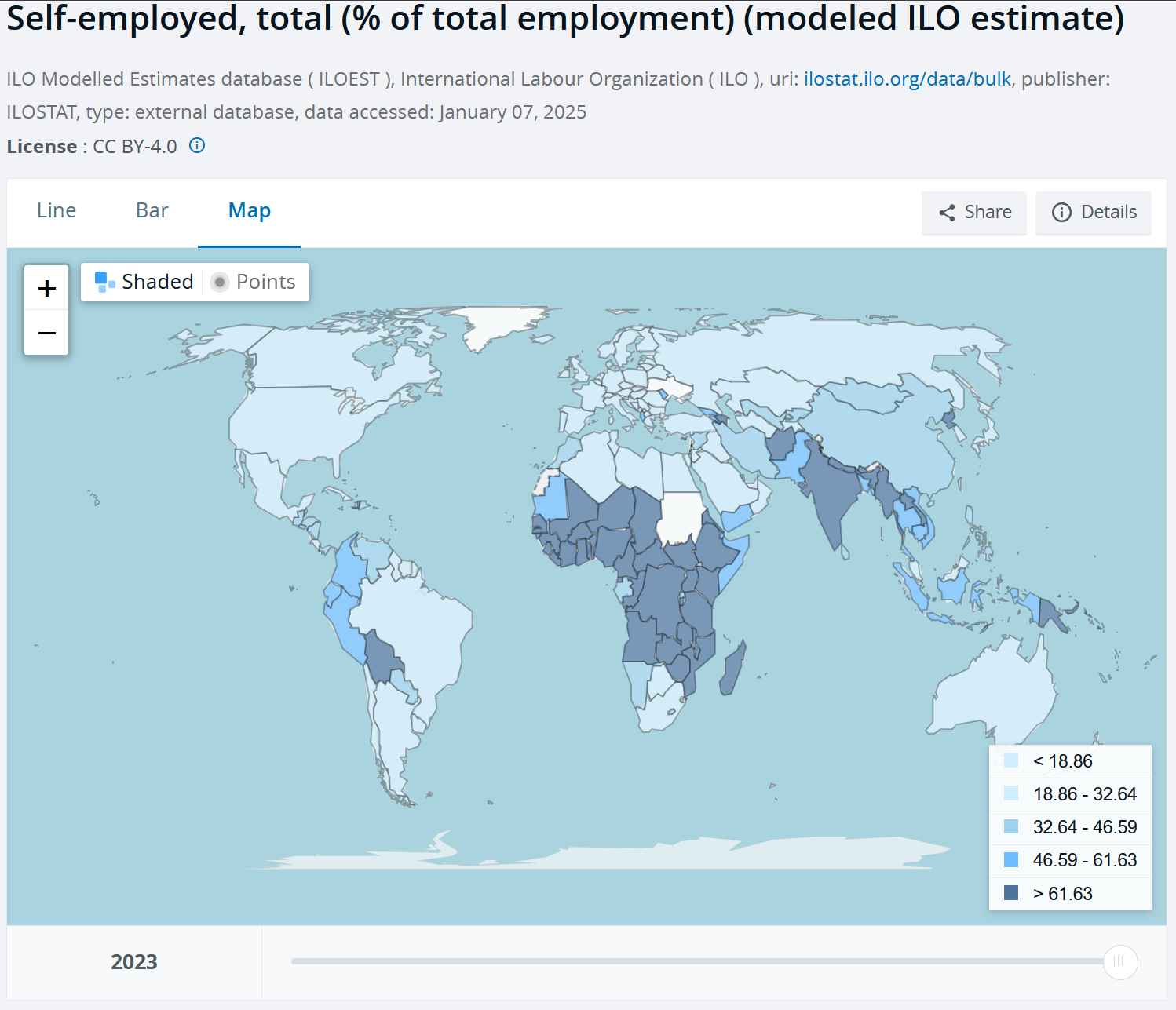

…and local businesses constantly close in favour of big companies, as countries develop the amount of self-employed people goes down:

Local businesses simply cannot outcompete ever-growing big businesses, and because big businesses are in a need to ever-grow to satisfy the raising stock value imperative, they inevitably intrude the market share of local businesses. This is well-known since the mid-1800s.

Hm, I would expect that to be true, as in “where a McDonalds opens up, there’s less demand for local family owned restaurants”, but I would not take the rate of self employment as proof.

In developed countries exist more laws against pretended self-employment and more small businesses incorporate, thus lowering those numbers.

I hate it. It even bleeds over into performance reviews. Like you’ll never get a perfect score no matter how hard you work because you always have to be improving on something. It’s supposed to be the sure fire sign of “success” but all it does is create impossible goals and bring everyone down.

I think the focus on growth is not the problem. The problem is leadership thinking that the individual has a significant role in how much they can create growth. The environment is much more significant.

Probably same reason cancer always needs to grow. It’s a fundamentally broken part of the system.

if you look closer you’ll note that it’s very much related to whether a company is publicly trader or not, as soon as people are trading stocks you end up with a bunch of people who don’t actually care about the company and those involved in it, they only care about making money.

a company that isn’t having stocks traded around is able to focus on things other than growth, such as making sustainable revenue or being a public good (or a personal good, like a small café that barely makes any profit and just exists because the owners want to run a café).

I didn’t see a single top level comment be the devil’s advocate so I will give it a try.

Humanity moves forward. Standards are always shifting. New technologies and needs are created everyday and people want to raise their standard of living to accommodate for new things. Also, global population has been growing since we stabilized food production in the 1800’s.

If companies don’t grow at least with population, that means tomorrow we will have less than today. If companies don’t also grow with raising standards of living, that means someone stays poor. If companies don’t also grow to match the complexities of producing new technology, that means we stopped in time technologically.

In a competitive system such as capitalism, you don’t wait for more competitors to show up and fill this new ever-growing demand; you take that demand for yourself. So everyone seeks growth.

When a society does not grow (i.e. japan) for too long, capitalism doesn’t break down immediately, but you clearly see it stagnates. Japan’s population is not stable and their economy is facing major problems.

Whether growth is organic or fabricated is a related, but different, topic

I work in a mid size company that is a leader in the niche market that we do. However we need to innovate and acquire other small companies and expand because we do have competitors. So the world around us is telling us to innovate or lose the market.

One aspect I haven’t read about: competitive pressure and economics of scale.

So, imagine two carpenters: they both produce one chair a day. They sell it and can sustain their families with that. Now the one carpenter works a little overtime and uses sharper tools: he’s able to produce two chairs a day. He still needs only to sustain his family, so he could sell the chairs at 50% discount. But he goes for 75% of its original price. Still cheaper, he has more.

Everybody wants to buy those chairs now: they’re the same, but one is way cheaper. The other carpenter loses business, he can’t sustain his family anymore, because he needs to sell one chair a day at least. To keep up, his business needs to grow now.

Because they take investment.

Privately held companies can sit around earning the exact same amount of profit forever.

But if you are publicly traded on the stock market, people are walking up and injecting money into your business. They expect a return for that investment. And that means that the part of your business they’ve bought has to be worth more in the future in order for them to sell it for more than they bought it.

Therefore: growth. Owning 1% of a $100k business isn’t with as much as owning 1% of a $200k business. So if you own 1%, you want it to go from $100k to $200k.

If you aren’t taking outside money, none of this is a problem. Unless the owners just want a raise, which most people generally do over time. If nothing else, inflation is constantly eroding the value of money so you need to grow a little just to stand still. Most people don’t want to make do with less and less over time.

This is also the issue with private investment companies.

When the EA deal was announced, people said more or less “this is proof that private isn’t any better than public”. Well that’s sort of true - there’s no guarantee that private is any better, but it CAN be, depends on who owns it. In the case of EA games, it was bought as an investment by a bunch of greedy investors, of course it’s going to be as bad as, if not worse than, a public corp.

It’s literally sad that the only hope for EA to become less scummy as a privately held company, than it was as a publicly traded company, is for the Saudi Arabian regime to proactively use them to win over gamers through the digital equivalent of ‘sports-washing’.

It’s depressing to think that we are at a point where EA could be considered the lesser evil in comparison.

Re: inflation, growth in pure gross/intake has to increase to match the currency devaluation, and that can mostly be done by adjusting your prices in line with inflation. Employee count, market shares etc. can all hold steady, all else being equal.

They don’t. It is a fallacy. Category error.

They do because shareholders will sue if profit doesn’t rise.

You’re thinking of publicly traded companies. That is not “companies”.

That’s a useless comment that you damn well know goes against the intent of op and everyone else here

What an assinine take.

About .01% of companies are publicly traded.

The only thing requiring a company be public is the desire for growth.

It’s a fallacy. As stated.

My Limited Liability Company has had 1 client for 5 years. I am in the overwhelming majority of companies who have no need or desire for growth.

OPs statement is a category error.

No, you’re desperately flailing to try to think of yourself as correct when everybody knows you’re wrong. You’re well aware of the context of this discussion, and you don’t know what you’re talking about.

🙄

The context is ‘companies.’

99.99% of companies are privately held.

The only thing requiring a company to be public is the desire for growth.

It’s a fallacy. As stated.

Idiots began to demand perpetual growth and other idiots began trying to make it happen. And then it became institutionalized. And then the idiots forgot they were idiots.

Because greed